Support

Company

CUSTOMERS

Stay in Touch

Sign up to our newsletter to stay informed about PCI compliance news, and updates regarding new BlueTime features.

RISK ASSESSMENT

The importance of protecting traveler credit card data cannot be underestimated. At the same time, it is equally important for the customer to protect themselves from possible credit card fraud and the ramifications (costly chargebacks, damage to company reputation, etc.) that arise from fraudulent transactions.

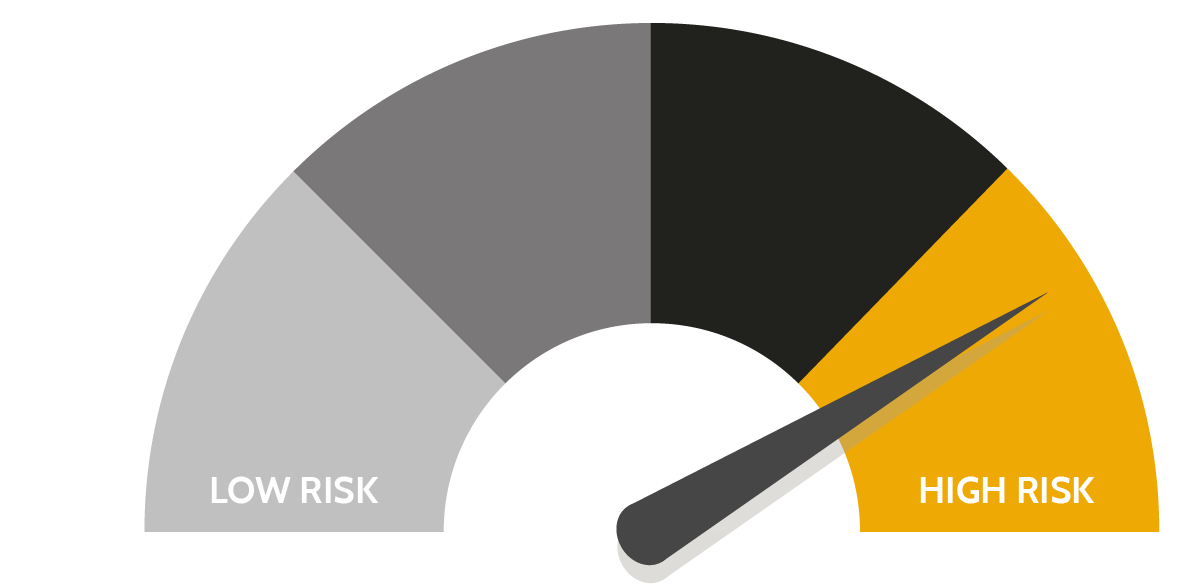

In addition to covering your tokenization needs, PCI Booking now offer risk assessment validation on captured credit card data. Risk Assessment returns a ranked-score that allows customers to determine the level of caution should be given to each transaction or reservation.

Avoid credit card chargebacks by intercept potentially fraudulent transactions prior to processing the payment.

Risk assessment is performed in real time as data is entered into the payment form, instantly recognizing any suspicious cards.

Choose the best course of action with Risk Assessments scaled risk rankings.

Through the use of an algorithm designed to highlight known credit card fraud characteristics, each card will be assigned a score corresponding with different levels of threat.

Scoring is based upon:

Each score will be accompanied by a ranking that represents the level of caution that each card should be handled with. Complete list of risk result levels:

Billing address, IP address and card issuer country all agree.

Transaction originating from location different to card issuing country.

Mismatch detected between billing address and credit card issuer country.

Use of an anonymous proxy server, or a discrepancy between billing address, card issuer and IP address.

For example, if discrepancies are found between the traveler’s IP address, their billing address and the country from which the credit card was issued, a response of Very High Risk will be issued.

Seamlessly include Risk Assessment as a supplementary stage in the card tokenization process. Customers may request that a risk assessment score be generated in addition to the creation of the PCI compliant card token. This will allow the customer to make a more informed decision in regard to suspect reservations.

Sign up to our newsletter to stay informed about PCI compliance news, and updates regarding new BlueTime features.